defer capital gains tax real estate

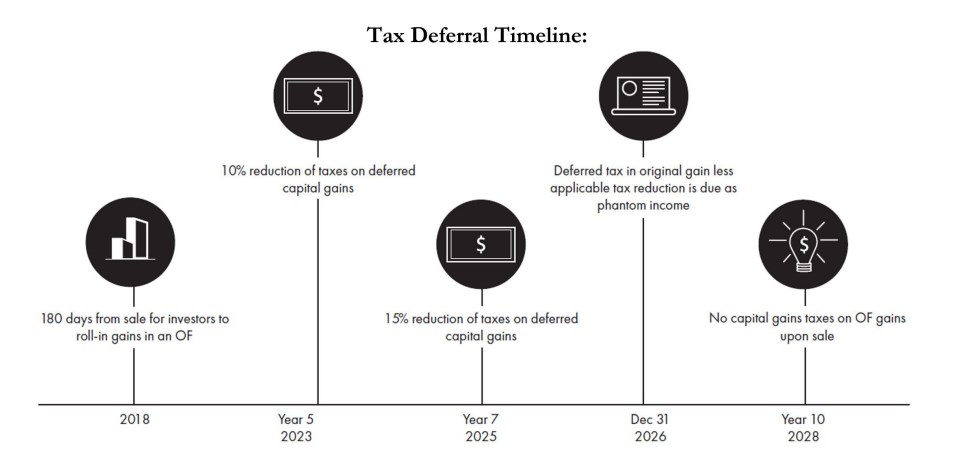

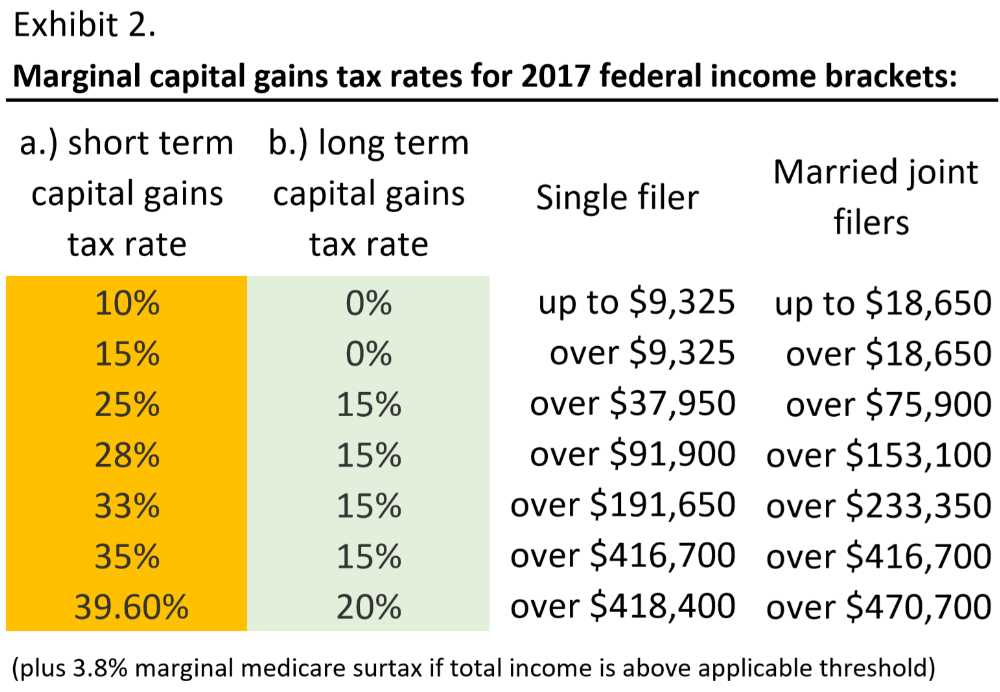

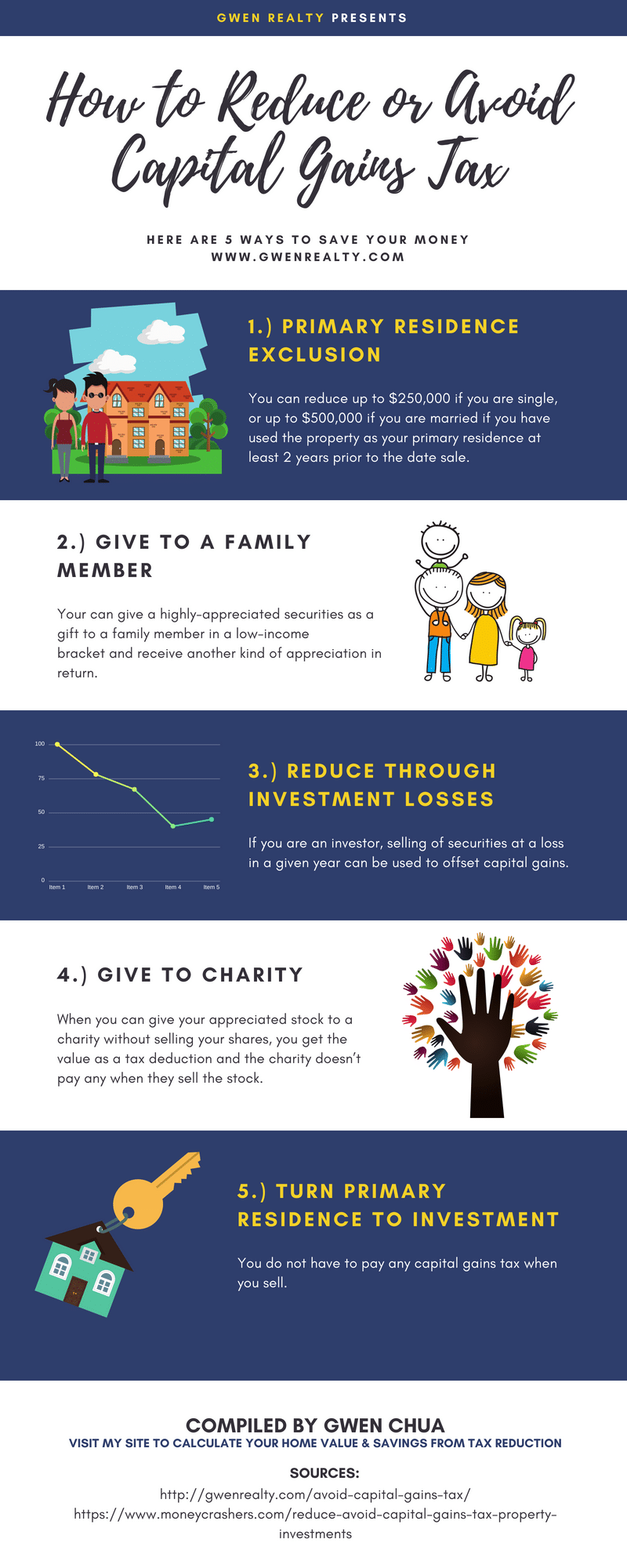

Receive a full exemption from any capital gains tax on all future capital gains from the invested funds if the investment is held for at least 10 years. Here are 10 ways to cut capital gains taxes legally as part of your tax toolkit.

A New Opportunity To Defer Capital Gains Tax Is Here Tidwell Group

When you dispose of a property and generate a capital gain you can defer tax.

. We want to help create a win-win situation for all parties. This ones obvious so lets get it out of the way. If you want to stick with real estate when.

500000 of capital gains on real estate if youre married and filing jointly. National 1031 Exchange Services. If you have made a significant investment into a real estate asset then selling that property can give you a large capital gains tax which you must.

Hold Properties for at Least a Year. Benjamin Franklin once said Nothing in the world is certain but death and taxes However things have evolved in the real estate market quite a bit since Franklins day. Real Estate Tax Strategies.

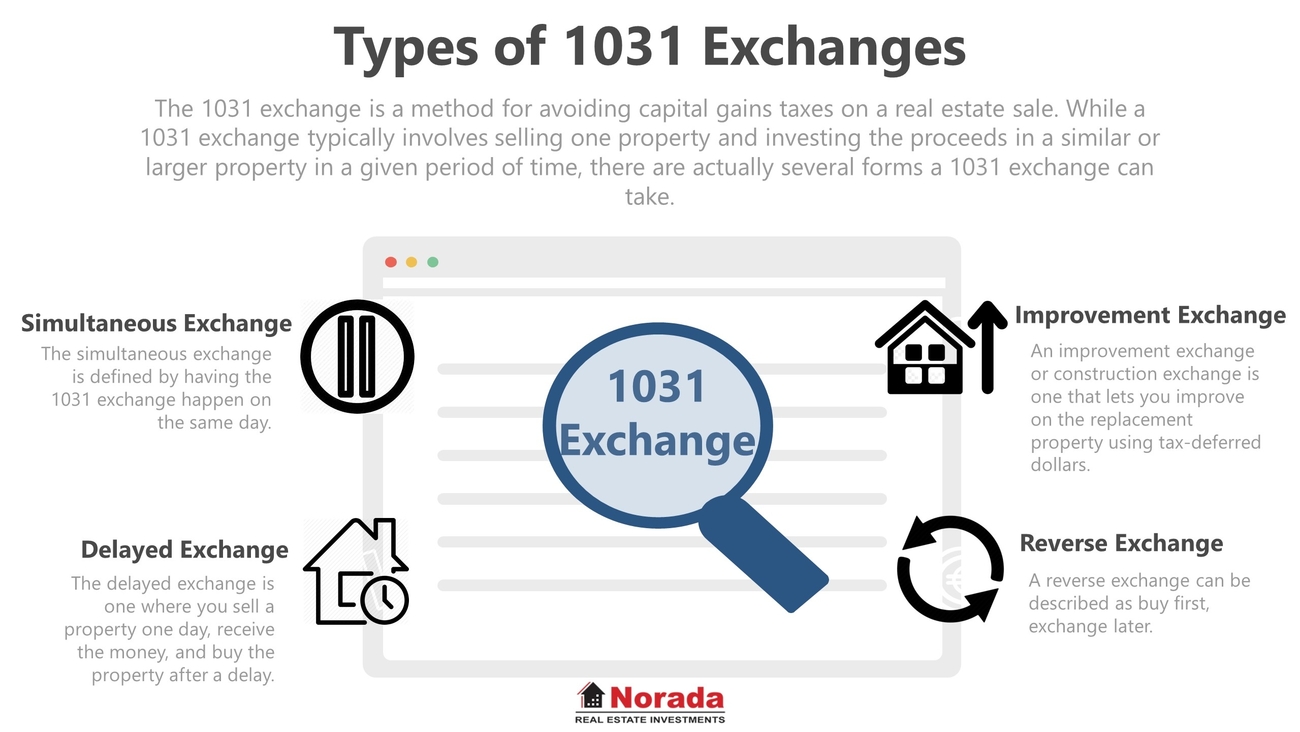

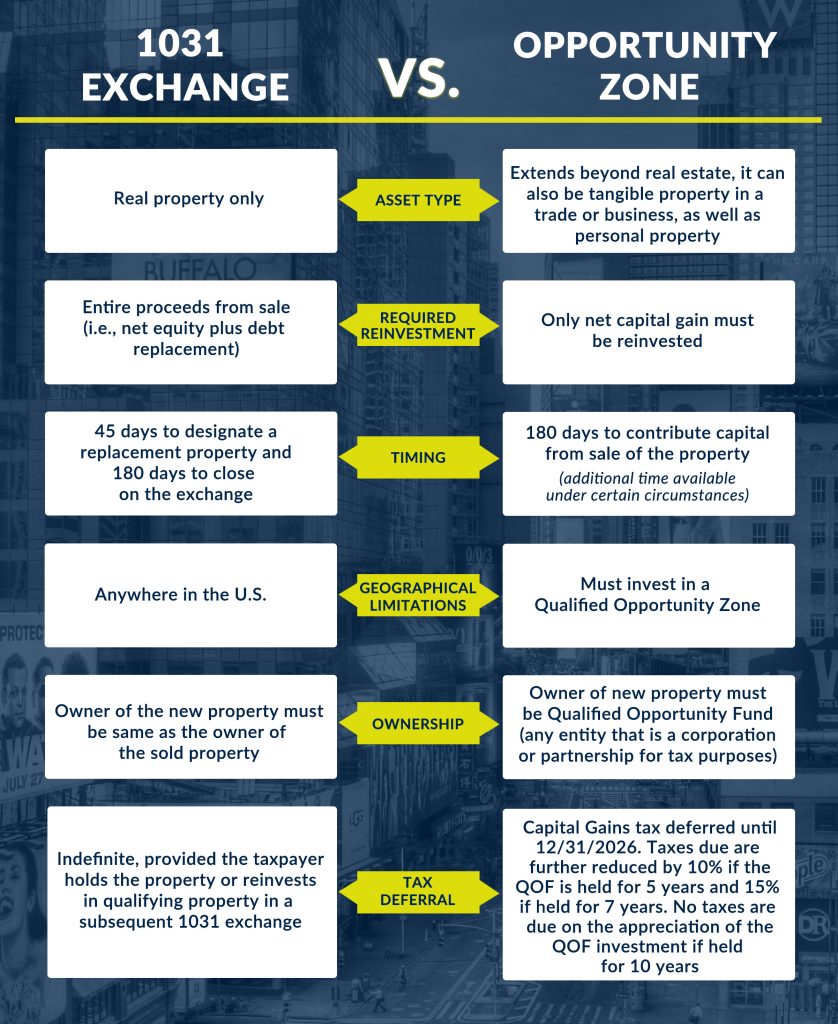

A 1031 exchange can be used to defer capital gains tax on a property sale. As outlined above if you. If you want to sell an investment property but dont need to cash out just yet you can defer paying.

Trusts Wills and Probate for CA 408 437-7570. Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly. Claiming this reserve will allow the deferral of.

To claim this reserve form T2017 in schedule 3 must be completed and submitted with your personal tax return for the year of sale. One of the major benefits of a 1031 exchange is that it allows you to defer paying capital gains tax which frees up all of your capital to put down on a replacement property. Without a proper tax planning approach the total taxes due for the sale.

Defer Capital Gains Tax. Defer Capital Gains Tax. Lets sit down and discuss your property and your financial goals.

If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling. Use The 1031 Exchange. Give us a call now to learn more.

The gains tax is imposed at the rate of 10 on gains derived from transfers of real property where the property is located in New York State and the consideration for the transfer is 1. Can you avoid capital gains tax by reinvesting in real estate. From a tax standpoint an even better approach would be to donate appreciated securities to charity when planning a sizable donation and let the charity sell the stock.

Deferral election is not taken but can claim CCA. Real Property Transfer Gains Tax Real Estate Transfer Tax June 22 1992 Section 59045 of the Gains Tax Regulations provides in pertinent part as follows. Deferred Gain on Sale of Home repealed in 1997 was a tax law allowing homeowners to defer recognition of capital gains from the sale of a principal residence.

State Tax Rate 123.

1031 Exchange Rules 2022 How To Do A 1031 Exchange

How To Defer Capital Gains Taxes Without Time Limits Prei 375

Selling Real Estate Without Paying Taxes Capital Gains Tax Alternatives Defer 9781419584374 Ebay

Deferring Capital Gains Taxes In Real Estate With A 1031 Exchange Everything You Need To Know Sage Real Estate

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

Like Kind Exchanges Of Real Property Journal Of Accountancy

Tax Deferral Strategies For Real Estate Investors A Compact Guide

What Is A 1031 Exchange Rules Requirements Process

Real Estate Tax Benefits The Ultimate Guide

Defer Capital Gains Using Like Kind Exchanges

What You Need To Know About Opportunity Zones Progress Capital

How To Defer Capital Gains Tax With A 1031 Exchange 1031 Crowdfunding

Commercial Real Estate Entrepreneur

1031 Exchanges How To Exchange Property And Defer Capital Gains Tax Stellarquest Real Estate Youtube

How To Avoid Capital Gains Tax And Save Your Hard Earned Money